Do you live in Italy and use DEGIRO to invest your savings? Or are you about to start doing so and want to find out how your tax return works if you use this platform? Sometimes it's unclear how you do that exactly, and foreign brokers like DEGIRO don't provide clear instructions and as they are based abroad, they act under the declaratory regime, which means that it will not act as a tax withholding agent for you.

But what does this mean? In a nutshell, you will be responsible for declaring your investments and calculating and paying the taxes you owe to the state and the broker will not do it for you. If this scares you, rest assured as we wrote down everything you need to do to declare your taxes the right way and the steps you need to do this without making a mistake.

Why do you have to declare your assets on DEGIRO?

If you decide to invest with DEGIRO, whatever the amount, you must always declare your investments, even if there are few movements or you have not realised any capital gains.

If you fail to declare them, you risk incurring tax penalties, such as fines or interest on unpaid taxes. Moreover, failure to make a declaration may lead to further scrutiny by the tax authorities, potentially causing you further legal and financial complications. Note that if you use a broker acting under an administered regime (such as Directa or Fineco), you will not have to worry about anything, as they will declare and pay what you owe to the Italian State on your behalf.

Have you been investing for a while but never filed a tax return?

In this case, you can always use the mechanism of the 'ravvedimento operoso', that is the procedure that allows you to regularise your tax violations spontaneously by paying the taxes due plus a reduced penalty before any checks by the Internal Revenue Service.

Declaring your DEGIRO tax return

The DEGIRO tax report

Whether you are a VAT-registered freelancer, an employee or a student, DEGIRO comes to your aid by providing you with an annual report for your tax return. The report helps you declare your taxes.

This greatly simplifies the process for you: all you have to do is copy the data contained within the report into the corresponding boxes from the revenue agency website. Unfortunately it has to be said that in recent years the delivery of the report (which usually takes place in June) has suffered from delays and corrections from time to time, creating quite a few inconveniences for DEGIRO users.

Where can I find the DEGIRO tax report?

You should receive a yearly email from DEGIRO. Head on over to your DEGIRO account (on the web or in the app) and go to "Posts" and click on "Documents". There's then a section under "Reports". You'll see that there's an annual report for you to help file your tax report.

What taxes will you pay

There are two taxes you'll have to declare and pay when using DEGIRO:

- Capital gains: equal to 26%, due if profitable positions were closed out during the year

- IVAFE: equal to 0.2% of the value of financial assets held

Note that there is a third tax but fortunately DEGIRO pays the Italian Financial Transaction Tax (also known as the FTT). DEGIRO automatically calculates, withholds, reports, and pays on behalf of clients the Italian FTT due.

Let's see now how you have to declare your tax position if you use DEGIRO. As mentioned earlier, the declaration follows different procedures depending on your employment situation.

Declaring your tax return if you're an employee

Income from financial instruments with DEGIRO requires the use of the personal income model (formerly the Modello Unico), in addition to or instead of the form 730.

There are therefore two options: you can use the form 730 and supplement it with the Personal Income Form, or you can submit only the latter.

Submit using the form 730

In the first case, your employer will act as tax substitute, allowing you to balance tax debits and credits directly in your paycheck. You will have to integrate the various fields in the Personal Income Form using the data in the DEGIRO report and pay any residual taxes via F24. This option allows you to be less time-consuming, as you can submit the 730 and the Personal Income Form at different times (always the 730 first) and have the CAF (tax assistance centre) help you fill it in.

Submit using the Personal Income form

If, on the other hand, you only wish to submit the Personal Income Form, all you have to do is add the data in DEGIRO's report (with all the others already pre-filled). Beware, however: if you use other brokers under the declarative regime (or have other accounts abroad), it will not be enough for you to copy the data contained in DEGIRO's report, but you will probably have to consult an accountant to make sure you do not make mistakes.

How can you actually declare your investments on DEGIRO? By filling in the RW and RT boxes of the personal income model.

- Go to the Agenzia dell'entrate website and access your personal area

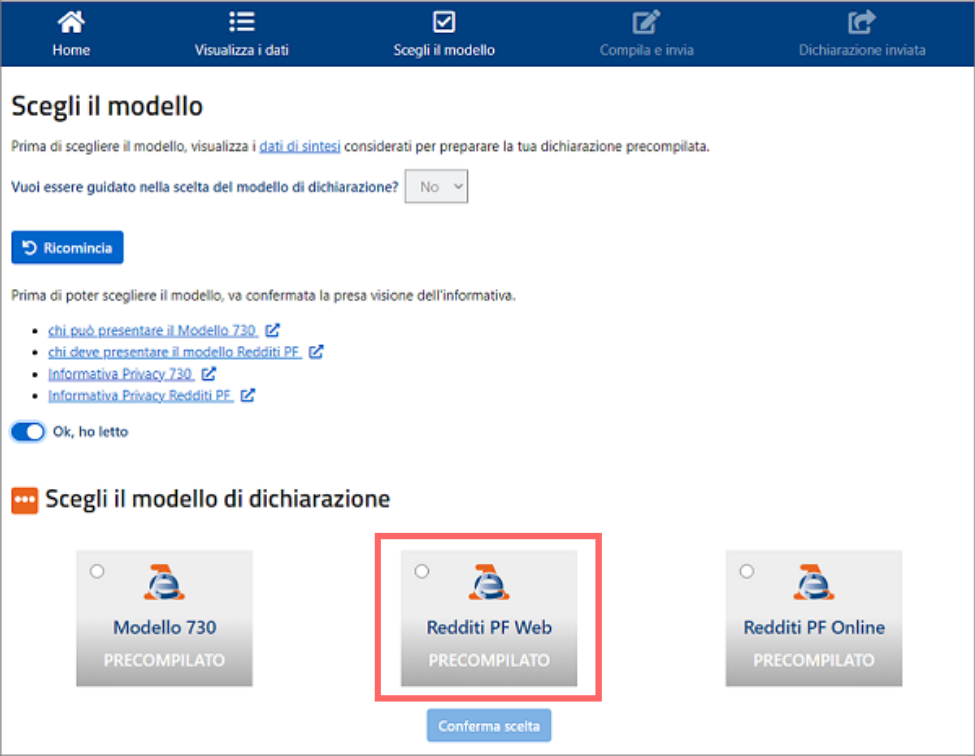

- Click on "Modello Redditi PF Web Precompilato"

- Fill in the RT, RM and RW forms according to the DEGIRO report

In the RW panel, the one relating to the monitoring of financial assets abroad, you will have to copy the information contained in the DEGIRO report point by point.

Note that if you have not made any capital gains and the IVAFE due is €0.00, you must also tick the box 'Monitoring only'.

If, on the other hand, you have sold positions in profit, you will also have to fill in the RT form (again, referring to the figures in DEGIRO's report). Once you have filled in all the fields, you only need to confirm the different sections and submit your tax return.

Declaring your tax return if you're a freelancer

If you're a freelancer, you cannot present the 730 form, so you will have to use the "Modello Unico" form.

The easiest way is to present documentation regarding your movements to the accountant you already use: they will take care of declaring your investments along with your VAT income.

Declaring your tax return if you're a student

If you're a student, you will still have to file a tax return if you use DEGIRO. Use the Personal Tax Form and fill it in with the data in the report, but it may be useful to consult an accountant or the CAF (tax assistance centre) who will be able to assess your situation accurately.

Summary

If you're living in Italy and using DEGIRO for your investments or planning to do so, it's essential to understand how your tax return works when utilizing this platform. DEGIRO operates under the declaratory regime, which means they won't act as a tax withholding agent on your behalf. Therefore, you are responsible for declaring your investments and calculating and paying the taxes you owe to the Italian state. While DEGIRO can simplify the process of declaring your investments for tax purposes, it's crucial to stay informed and ensure you meet your tax obligations to avoid any potential penalties or legal issues. Sometimes DEGIRO's report does not arrive on time and may contains errors. If you want to avoid any kind of problem, whether you are an employee, freelancer or student, it might make sense to contact someone knowledgeable to help you with this task.